Address newsletter

Get the latest news on buying, selling, renting, home design, and more.

Five percent of Massachusetts homes aren’t insured, the Consumer Federation of America reported in March. With premiums expected to hit a record high in the United States this year, inflation driving up construction costs, and climate change ratcheting up the disaster risk, it’s surprising the number isn’t higher.

In April, Colorado State University predicted an “extremely active” 2024 hurricane season: with 23 named storms — five of them major. Between 1991 and 2020, we averaged 14.4 named storms a year, according to the report.

It’s easy to become complacent when the last official hurricane to hit Massachusetts was 32 years ago: Bob, a Category 1, in 1991. But the catastrophic flooding in Leominster last September is a sobering reminder that you don’t have to live on the ocean or be in the path of a hurricane to feel Mother Nature’s wrath.

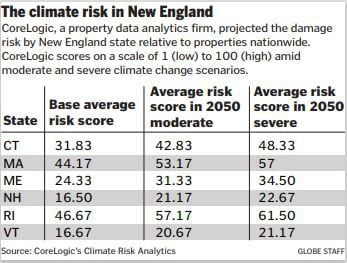

CoreLogic, a property data analytics firm, projected the damage risk in New England states, relative to all properties nationwide. CoreLogic’s Climate Risk Analytics scores on a scale of 1 (low) to 100 (high).

But risk is only one of several factors that affect premiums.

“Many factors impact home insurance premiums and losses,” the National Association of Insurance Commissioners reported in 2023. “Real estate values, building and construction costs, vulnerability to catastrophes, the level of urbanization, and legal and economic phenomena result in wide variations in premiums, not only by region or state, but on local levels as well.”

Steven J. Aronson, principal and CEO of insurance and business adviser Acrisure Needham, said that while most homeowners think about how their insurance policies affect them locally, premiums collected from homeowners here are used to pay the claims from California wildfires and Gulf Coast hurricanes.

And even insurance companies need insurance to mitigate the risk, and this “reinsurance” also affects your premium.

Aronson said the cost of reinsurance “has been going up every single year, and retail insurers have to pass along those costs to the consumer as well.”

The average premium for a typical Massachusetts homeowner in 2020 was $1,699, according to the Massachusetts Division of Insurance. In 2022, the latest year for which data are available, it was $1,818, a 7 percent increase. Compare that with Florida, where premiums are expected to climb that much this year alone, according to a 2023 report from Insurify, a digital insurance agency.

Aronson said most homeowners have mortgages that require insurance, policies are usually designed to take into account the rising costs of construction and repairs, and many homeowners without mortgages want to protect their investment and take out policies even though they’re not required to do so.

“We know that most losses are not total losses, so some folks might only want to buy $100,000 or $200,000 policies,” he said. “But the rating models are built on the assumption that everyone is insured to full replacement cost value. So we can’t write a $250,000 policy on a million-dollar replacement cost home, even if that’s what the consumer would like. The rating models just don’t support that kind of buying decision.”

Insurance is something you hope you never need, but there are ways you can mitigate the costs without putting yourself at risk.

Aronson cautioned against simply shopping for the lowest possible premium. The company offering the lowest-cost policies today may not be the lowest next year, he said.

Not many people can afford to lose their home and pay to have it rebuilt out of pocket.

‘Self-insurance certainly is an option if you don’t have a mortgage, and quite a few of our clients who have sold a home here took a bundle of cash and bought a home in Florida with no mortgage and, given the cost of insurance in Florida, are choosing to self-insure,” he said.

But home insurance protects you against more than storm damage.

“When you buy homeowner’s insurance, you’re also getting personal liability insurance,” he said. “It’s part and parcel with the policy. It insures your home, [and] it also insures everything inside the home. It also insures slip-and-fall liability. It’s a lot of protection.”

Stephanie Kim, personal insurance supervisor at Acrisure New England, said the best ways to get and keep lower homeowner’s insurance premiums is to choose a plan with a higher deductible, minimize the number of claims you make, and discuss possible savings with your agent.

“We’re offering higher deductibles anywhere we can, because that’s your best way to save some money,” Kim said. “Talk to your agent so you understand what coverages are there. If you have $50,000 in water backup coverage and you have an unfinished basement, maybe you don’t need $50,000 in coverage. Customize your policy. There are little tweaks that we can make here and there that can be cost-effective. We can have these conversations with clients about what they really need without stripping away the important stuff.”

Predicting the future is always dicey, but no one in the insurance business is expecting premiums to go down, particularly when the cost of rebuilding and home prices in Greater Boston are still climbing.

“This is the new normal,” Aronson said. “The model suggests that despite all the rate increases we’ve seen, home insurance in Massachusetts is still underpriced, so the consumer should expect further increases over the next year or two.”

The National Association of Insurance Commissioners provides an overview of homeowner’s insurance policies at content.naic.org/cipr-topics/homeowners-insurance.

Jim Morrison can be reached at [email protected]. Follow him on X @jimmorrison617.

Get the latest news on buying, selling, renting, home design, and more.

Stay up to date with everything Boston. Receive the latest news and breaking updates, straight from our newsroom to your inbox.

Conversation

This discussion has ended. Please join elsewhere on Boston.com